Morning Gold & Silver Commentary

The metals opened sharply higher but have given back the gains in European trading. The US Dollar has hovered around unchanged all day and is currently marginally higher. Last week presented numerous potential headwinds to the bulls. Until Friday the US$ remained strong, the Fed raised the discount rate and the IMF said it would begin to sell more Gold. Yet, despite all the bad news Gold and Silver basically closed near the highs of the week. Does that translate to immediate follow through this week? Not necessarily, but it one has to think that is bullish as we are nearing spring.

Gold popped in early Asian trading and has since been unable to hold the gains. That being said, the short-term technical outlook for Gold remains positive. The market is in good shape as long as it can close above the $1120-$1125 resistance area. A daily close above $1125 would propel the market to resistance at $1150. Looking at a longer time frame, we see nothing wrong with the market pulling back for a day or two. Look for support at $1116-$1118.

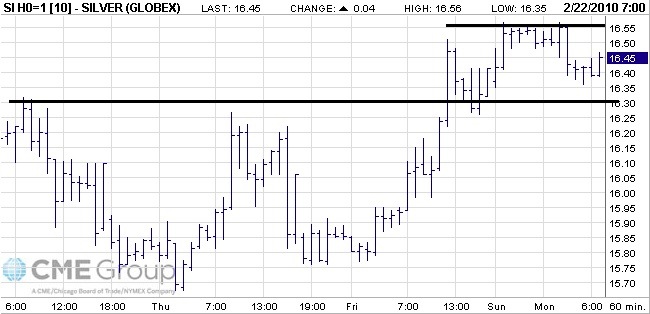

As you can see, Silver has been leading Gold over the past few days. It’s recent double bottom shows a stronger higher low on the second bottom. Also, Silver has already cleared the initial resistance at $16.30. Going forward, Silver’s gains will be slowed as there is a lot of short-term resistance to contend with. A larger time frame shows the previous breakdown below $17.00. We see $16.75 as initial resistance, followed by $17.00. Looking forward, Gold has less overhead resistance then Silver. Keep an eye on the Gold/Silver ratio.

[ad#WSCS Ad#2]