Morning Metals Commentary

Copper

Today (Wednesday), Copper is lower by about less than 1% in the overseas session. The market opened Asian trading sharply lower and has since recovered gradually.

News of the earthquake in Chile boosted the market on both Monday and Tuesday. Chile is the world’s leading copper producer. The reports proclaim that most mines are resuming operations and that activity at the largest ports is back to normal.

Ironically, Copper’s strength is being driven by other unidentified factors. We say unidentified because we aren’t sure and neither are many of the pundits. Inventories at the London Metal Exchange are at a five-year high, China has restocked while now tightening its monetary policy and the COT structure remains negative, as non-commercial traders are modestly long. Furthermore, one must note the long-term resistance in the 300-400 range.

For the time being, macroeconomic factors seem to be overriding copper-specific fundamentals. Widespread currency weakness (as a result of sovereign debt troubles) is enhancing the appeal of commodities as a store of value. Note that while Copper has yet to surpass the early January high in US$ terms, it already has against most foreign currencies, including the British Pound and the Euro. The US Dollar index is now struggling at resistance at 81 and that removes an impediment to all commodities. Also, perhaps the worries about a dramatic slowdown in China are overblown?

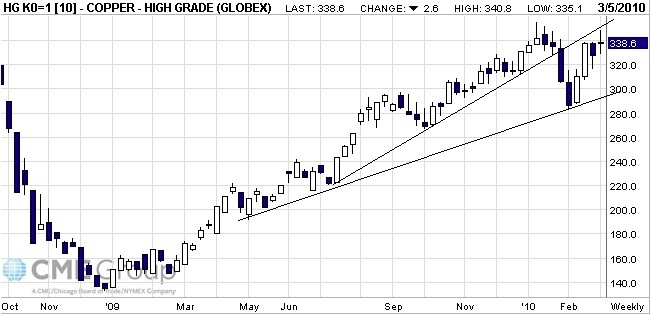

The trend is your friend and for the May 2010 contract it remains intact. The weekly candles illustrate how 340 is strong resistance. The May contract has yet close above 340 on a weekly basis. A close above 340 should take the market to 355, the early January high.

Platinum

As we go to press, Platinum is higher by $3 to $1579. It appears to be following the precious metals.

In January we saw the debut of the first Platinum ETF. It comes from ETF Securities Ltd and is backed by Platinum. Investment demand only comprises 8-9% of total Platinum demand. The lion’s share comes from automobile demand (70%). Investment demand in Gold has surged in the last five years. If the bull market in precious metals continues, Platinum is sure to benefit by way of greater investment demand. Investment demand for Platinum may be in its infancy, though the introduction of the ETF is a turning point.

As we noted, macroeconomic factors seem to be driving the commodities markets. Sovereign debt troubles are causing widespread currency weakness, which in turn, is enhancing the appeal of commodities as a store of value. Yesterday Platinum closed at a new recovery high in Euro terms. A few days prior it closed at a new recovery high against the British Pound. Hence, it is always important to judge markets in real terms. How is one performing against the other markets? It helps to expand our analysis. Platinum has held up very well despite a strong rally in the US Dollar.

Technically, a move to 1600 is very likely. The market has tried and failed thrice to surpass 1600 on a weekly basis. A close above 1600 should take the market to its January high near 1650.

Gold

Gold finally took out resistance at $1120. It is solidly higher today, having held above $1130 in both Asian and European trading. Yesterday the buck was higher but that didn’t deter Gold. Today, the greenback is marginally in the red. The next target for Gold is $1150, which looks very likely. A close above $1170 and we can expect $1200-$1220.

Silver

Silver has more resistance to deal with. Go back several months and one can see that there figures to be a lot of supply around $17.00. If Silver can sustain its strength and follow Gold, then we’d look for $17.50- $17.75 to be the next stopping point.

[ad#300×250 White Text Ad]