News, Charts & Premium Samples

In this update…

– Links of the Week

– Sponsor News

– Premium Sample: Equity Fund Flows

– Premium Sample

Links of the Week…

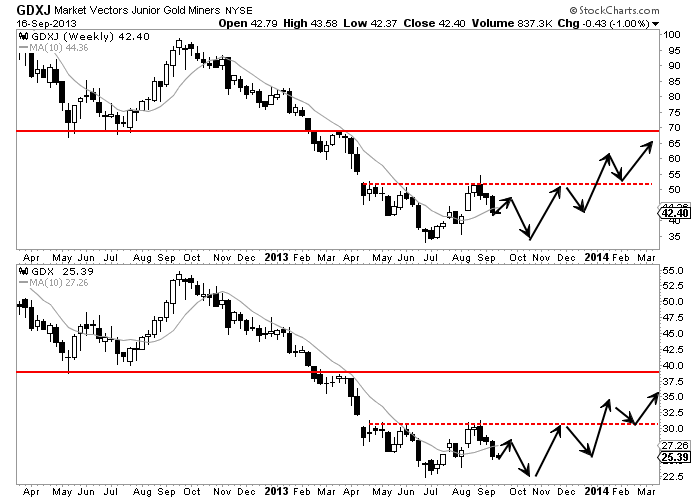

Historic Buying Opp Coming in Gold Stocks

We had to change our tune because the data changed. If gold stocks make a double bottom then its a historic buying opportunity.

Generalist Fund Managers Interested in Gold & Silver Miners?

Interesting note from Blogger Dave. The Denver Gold show is one of the most important industry conferences as it involves highly regarded companies and the big money. While Gold funds have been getting killed, someone has to come in and pick up the slack. Maybe generalist funds are the ones bottom picking while industry funds are getting redemptions.

Jim Rickards: Fed Knows Gold Has to Go Higher

Great interview from Daniella Cambone @ Kitco. Rickards said the Fed is okay with Gold going higher as long as its orderly. They want inflation but in an orderly manner. Nothing was orderly in spring and summer 2011.

Gold Fundamentals

Solid article from Steve Saville, one of the best writers out there and one of the most informed people on precious metals. He doesn’t resort to the fear and hype that so many do.

Why B2 Gold’s Prospects are Up in an Era of Write-Downs

Great Article on B2 and its founder & CEO, Clive Johnson from my friend Tommy Humphreys. Clive Johnson has built back to back Billion $ companies.

Sponsor News…

Bear Creek Mining’s Corani Project EISA Approved

Very important news for the company. The EISA is critical as its approval ushers in the permitting process which BCM CEO Andy Swarthout discussed in our recent interview.

Corvus Gold Demonstrates Continuity w/ Continued Expansion of YJ Zone

Corvus continues to expand the high-grade Yellow Jacket discovery. Its proving

Balmoral Resources Outlines Large New IP Anomaly

This newly discovered anomaly is flanked by the high-grade zones @Martiniere. It will be exciting to see if this anomaly can produce more high-grade oz.

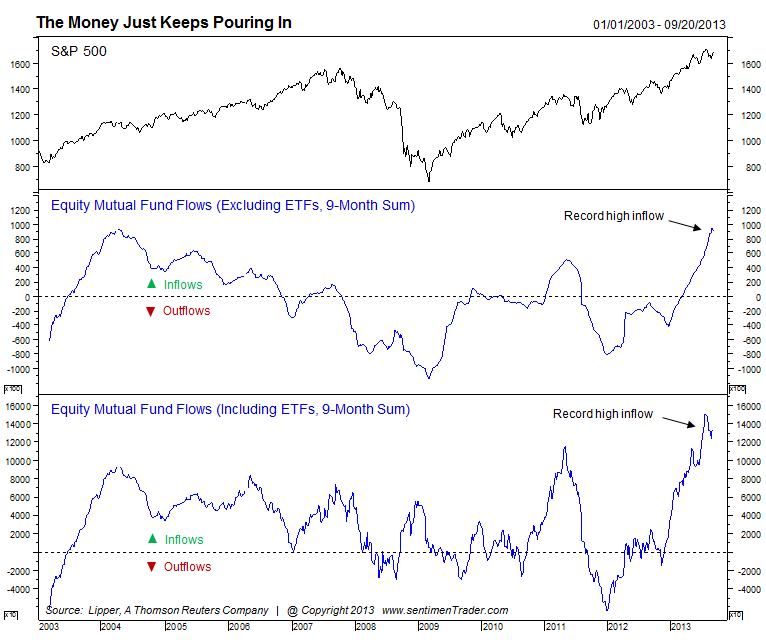

Premium Sample: Equity Fund Flows

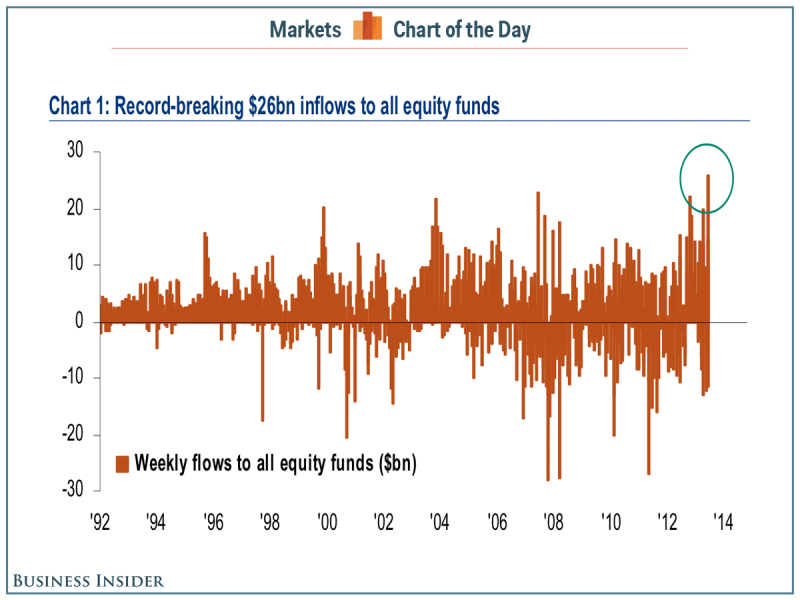

We just completed a significant macro-market report and these two charts are just a small sample of the content in the report. The first chart is from Sentimentrader.com. It shows equity fund flows (measured over a rolling 9-month period) at 10-year highs.

This chart shows weekly equity fund flows. Flows last week hit an all-time high.

What signal do we get from these two charts? What is the significance of record fund flows in 2013 versus large flows in 2010 or 2011? This is something we cover in the report.

Premium Sample:

We wrote last editorial (linked above) a few weeks ago. We had to change our views because the data had changed. The gold stocks veered off their recovery course and failed to hold the 50-day moving average. However, the good news is we don’t expect to see new lows (at least in GDXJ and the silver stocks). Both GDX and GDXJ have been in a bottoming pattern for 5 months. The charts below show the developing necklines. Upon breakout of the necklines we have targets of GDXJ $69 and GDX $39.

That seems like a huge move from a potential retest at GDX $22 and GDXJ $35. However, consider that the typical rebound in GDX can go 70% in five months. In the recent two-month recovery, GDX gained 39% while GDXJ gained 63%! Even the silver stocks were up 55% in only two months. If we do see a bottom in October/November then there is a good chance we could see a 100% rebound in GDXJ by next May.

My friend Tiho Brkan emailed me recently and I wanted to share his near-term thoughts on precious metals with you.

Consider a subscription to TheDailyGold Premium and find out which stocks we believe will believe will be the leaders out of this bottom.

This week we’ve already put together a new report and updated another. We published a report covering our Top 2 Long-Term Speculations for this Bull Market. These are two speculations that we think have potential to be 20-baggers over the next four years.

In addition, yesterday we published a new Macro-Market Report. Its 49 pages and covers the outlook for US equities, Emerging Markets, Bonds & Commodities. I’m quite proud of this report as I think it helps us see where the opportunities are and which areas should be avoided. Feedback from subscribers has been quite positive thus far.

Get these two reports and much more!

Wishing you good health and profits,

-Jordan