Ongoing Correction in Gold, Silver & Gold Miners

I have been writing quite a bit about the super bullish setup in Gold.

The textbook cup and handle pattern has a measured upside target of $3,000 and a logarithmic target as high as $4,100. There’s also a smaller cup and handle pattern that projects to $2,500.

But, it is important to note, Gold remains in a correction.

Recall that it gained $300 in only six weeks. That move is being digested and corrected.

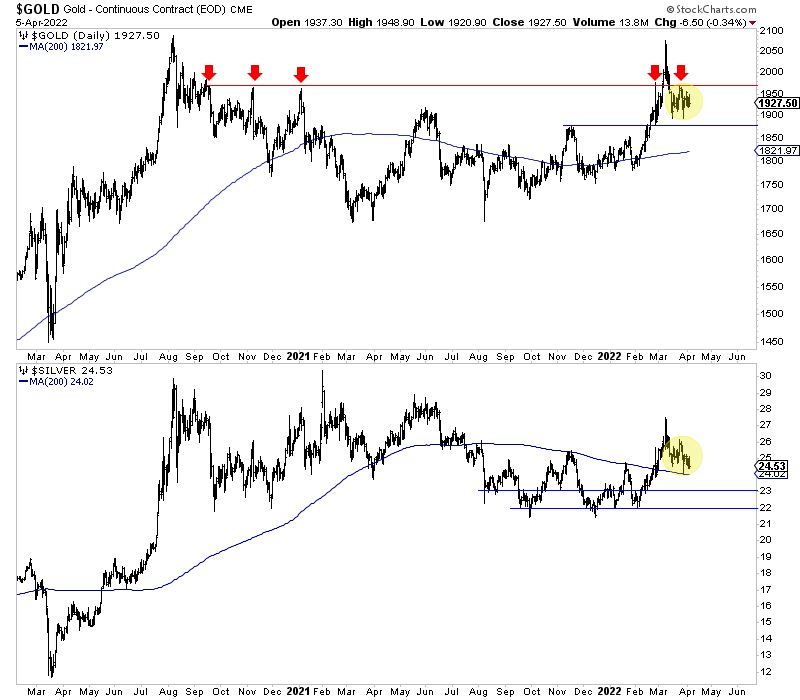

The technicals argue that Gold and Silver should continue to correct. Recent action (highlighted in yellow) is not favorable.

Gold has resistance at $1970 with support at $1900, $1880, and the 200-day moving average if it were to fall that far. Gold is much stronger than Silver as it rallied back to the August 2020 peak and is holding well above an upward sloping 200-day moving average.

Meanwhile, Silver could test support at $23. I anticipate that it will continue to lag Gold until Gold has broken above $2,100.

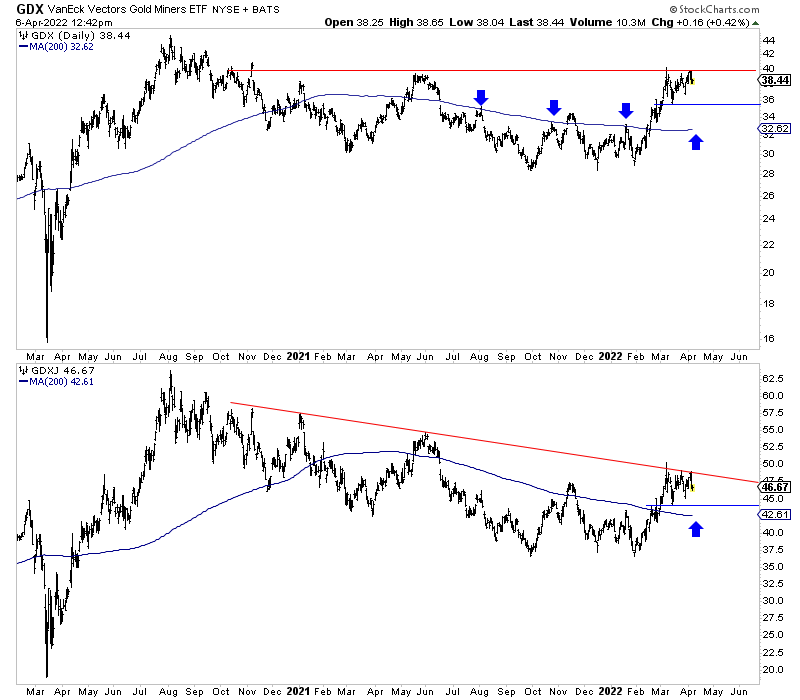

The gold miners and junior gold stocks have been outperforming, which is a great sign. However, this is a correction, and the probabilities favor the correction continuing.

GDX can test $35.00, GDXJ can test $44.00, and both can remain in a bullish consolidation. There is further support below those levels (200-day moving averages).

On the fundamental front, precious metals could react to the potential for more Fed rate hikes. The market is pricing in a Fed Funds rate of at least 2.50% by the end of the year.

The catalyst for Gold to break $2,100 and for this correction to end might be the market sniffing out the Fed ending its hikes. The most significant bottom of the past five years (August 2018) occurred some four months before the Fed’s last hike in that cycle.

We have a bit of time to get positioned before the market could begin a runaway move to the upside.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.