Sentiment Updates

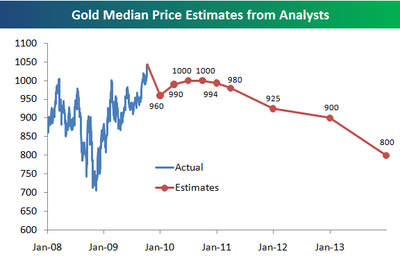

Below is the chart from Bespoke, showing analyst projections for Gold. Apparently these analysts don’t know what a bull market is. I doubt any of them is a technician either.

By Mark Hulbert, MarketWatch

ANNANDALE, Va. (MarketWatch) — Gold in recent weeks has provided a textbook illustration of a bull market climbing a wall of worry.

Contrarians accordingly won’t be surprised if gold exhibits continued strength in coming sessions.

The wall of worry in the gold arena is perhaps best appreciated by comparing gold market sentiment today with where it stood three weeks ago. Gold at the time was trading at more or less the same level it closed at Monday. And, yet, the average gold market timer is today a lot more discouraged about gold’s prospects than he was then.

That discouragement is precisely the kind of sentiment foundation on which higher prices are built, contrarians argue.

Consider the Hulbert Gold Newsletter Sentiment Index (HGNSI), which reflects the average recommended gold market exposure among a subset of short-term gold market timing newsletters tracked by the Hulbert Financial Digest. Its latest value is a quite-low 18%.

Three weeks ago, in contrast, the HGNSI stood at 39.5%. In other words, in the wake of a close-to-zero net change in gold’s price, the average gold timer has cut his recommended exposure level in half.

By no stretch of the imagination is this behavior consistent with the stubbornly-held bullishness that contrarians say is typically seen at major market tops.

The HGNSI’s current level of just 18% is amazing from another perspective as well: Even though gold is within a few dollars of a record, all-time high, the average gold timer is mostly in cash. Clearly, there is no irrational exuberance in the gold pits.

Why are the gold timers so discouraged?

There are lots of individual reasons, to be sure.

But I suspect that one underlying theme is concern that gold will, once again, follow the same script it did on each of the four prior occasions when it approached the $1,000 level. On those previous occasions, of course, gold’s rally failed and bullion dropped — sometimes precipitously.

And it certainly looked as if that script was being followed two weeks ago, when gold dropped down to the $990 level, after trading as high as around the $1,020 level. The panic that quickly captured many timers was reflected in a big two-day drop in the HGNSI — by 22 percentage points, in fact.

Just as contrarians would have expected in the face of that quickly strengthening wall of worry, however, that drop turned out not to be the beginning of a bigger decline. Gold instead started recovering, and on Monday rose by $14 an ounce.

According to contrarian analysis, the gold market will form a major top when two sentiment conditions exist: Bullishness will be at high levels, and that bullishness will be stubbornly maintained in the face of any market weakness.

Neither condition exists today.