The Looming, Big Catalyst for Gold

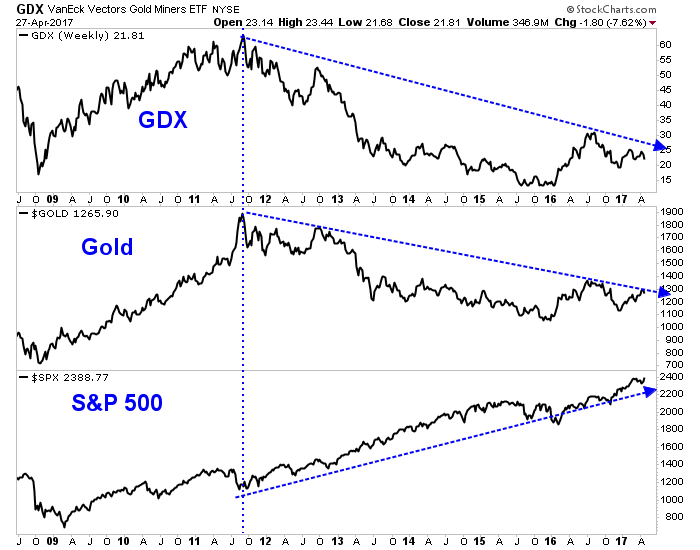

Gold bulls were hopeful that Gold could break its 6-year downtrend but recent underperformance in the gold stocks and Silver argued otherwise. Those markets have been crushed in the past two weeks as US and global equities pushed higher. In fact, the S&P 500, small caps and global equity indices have rebounded back to recent highs and in some cases new highs. There is no arguing that equities remain in a bull market while precious metals (ex Gold but not for long) are again below their 200-day moving averages. History shows that bear markets in stocks have sprung major bull markets in Gold and gold stocks. The conditions for such are in place once again and only the timing is uncertain.

Although precious metals made a historic bottom in January 2016, the negative correlation between them and the equity market which began in 2011, remains in place. During the first half of 2016 there was a chance the two assets had flipped. However, the major trend reasserted itself as the S&P 500 has gone on to make new highs in recent quarters while precious metals remain well below their summer 2016 highs.

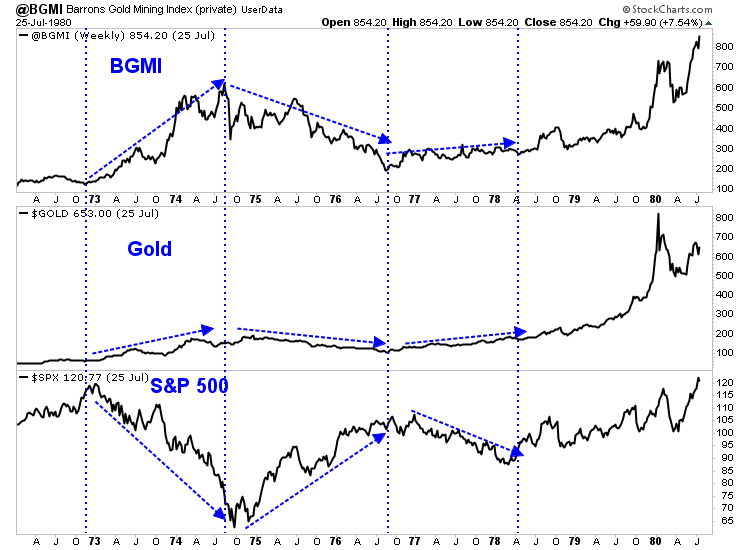

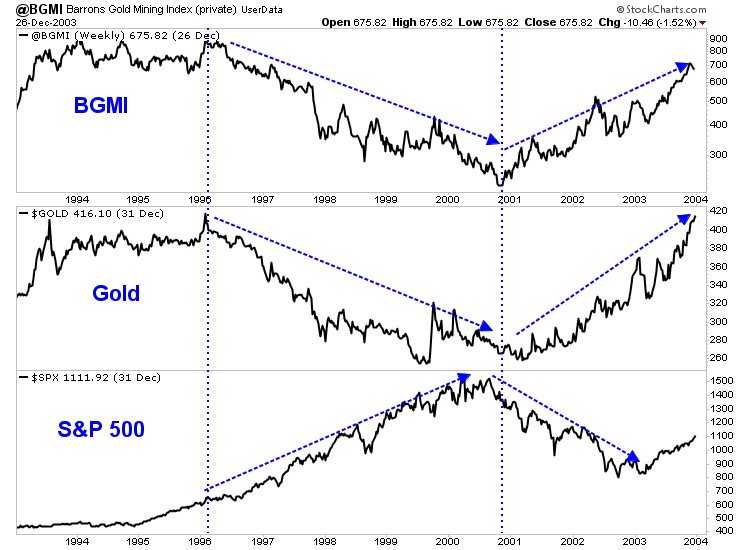

As discussed in our book and a handful of editorials over the years, there are historical examples of the sustained negative correlation between the two assets which led to great bull markets in precious metals.

From the end of 1972 into 1978, Gold and gold stocks traded opposite the stock market. The negative correlation remained in place for almost 6 years. The trends flipped twice. Gold and gold stocks surged during the 1973-1974 bear market but then endured the infamous 1975-1976 correction as the stock market recovered. Then as Gold and gold stocks recovered, equities endured a mild, 20% bear market.

The better comparison to today is the 1996 to 2002 period. Gold and gold stocks (and commodities as a whole) endured a vicious bear market from 1996 through 2000 as equity markets and the technology sector in particular soared. The senior gold stocks bottomed in late 2000 while Gold emerged from its double bottom in Q2 2001. Precious metals performed fantastically during that entire bear market in equities.

Circling back to the present, there is a fundamental explanation as to why the negative correlation will remain in place and ultimately trigger a real bull market in Gold and gold stocks. Here and now, a stronger equity market will compel more aggressive Fed policy which would push short-term interest rates and bond yields higher. Because inflation looks to have peaked and levelled off, Gold is vulnerable to a rise in nominal rates or yields. However, the stock market will eventually turn, the economy will weaken and the Fed will have to reverse policy. In addition, large fiscal spending could be required.

Hence, sustained economic weakness and a peak in the stock market is likely to be the catalyst to reignite the bull market in precious metals. It is quite logical from both a historical and fundamental perspective. Gold and gold stocks may be struggling now and it could continue but they are perfectly setup for a massive move higher once the stock market peaks. Over the weeks and months ahead, I intend to accumulate shares of the best junior mining companies on weakness. The massive move in precious metals during the first half of 2016 is only a preview of what lies ahead. We have to take advantage of the coming weakness or we risk missing the big move when it starts. For professional guidance in investing in this sector consider learning more about our premium service including our current favorite junior exploration companies.

Jordan Roy-Byrne, CMT, MFTA

Jordan@TheDailyGold.com