|

In this issue…

– Editorial

– Gold & Silver, Metals & Stocks

– Sponsor News

– Premium Snippet

Editorial…

Sunday we wrote that the short-term outlook was bullish. Go here to learn the reasons why we are confident that the precious metals sector has bottomed and why it will move higher into September.

Gold & Silver…

Gold has continued to “inch” higher but has yet to push through resistance at $1625. That is the key level.

Silver has also inched higher. Its short-term outcome is almost entirely dependent on Gold. If Gold pushes past $1625, then Silver could ultimately push above $30.

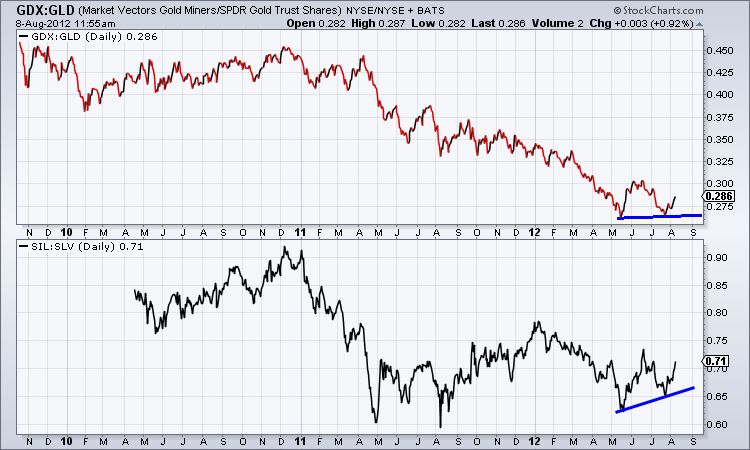

At key market turning points the stocks will lead the metals. Gold stocks have made a higher low and have moved higher relative to Gold. We see the same thing and more strength from the silver shares relative to Silver. The action in the shares is very encouraging.

Sponsor News…

Q2 earnings reports and calls are just starting…..

First Majestic will report earnings on the 14th and Argonaut Gold will report on the 15th.

Huldra Silver has been on a tear lately as shares touched $1.35 yesterday. The stock has held up quite well during this cyclical bear and that is all the more impressive considering its a smaller company.

Also, noteworthy is Coeur D’Alene’s investment in Huldra (as part of the recent private placement). Couer now owns 8.8% of Huldra (and 12.7% of the fully diluted shares). Couer is a $1.7 Billion company while Huldra’s market cap is less than $50 Million. This is very encouraging for Huldra and its shareholders.

Premium Snippet…

The model portfolio is up 6.4% year to date while GDX and GDXJ are down 14% and 19%. Our holdings have made progress recently.

Beyond that, we recently discussed the predicament of global markets in a global update. We analyzed this rebound, what it means, what Fed & ECB policy can do and what it cannot do. We also voiced a strong bullish short-term outlook for precious metals.

Next we are working on a portfolio update, in which we analyze our holdings, price targets, our watch list and reflect on strategy, do’s and don’ts.

Subscribe to our Premium Service

Wishing you health and profits,

Jordan

Disclaimer: Sponsor Companies are only sponsor companies of TheDailyGold.com. Do not construe sponsorship with a recomendation. We are not a registered investment advisor and information and analysis provided is for informational and educational purposes only.

|