What Happens Before Major Bottoms in Gold Stocks

There’s good news and bad news.

The good news is that gold stocks and precious metals at large are approaching a major bottom.

The bad news is that history shows potential for sharp selloffs in the weeks to a few months preceding these major bottoms.

Here is a look at the HUI Gold Bugs Index.

I noted the declines in the weeks preceding the lows and then the ensuing gains, which are always greater than 100% in bull markets.

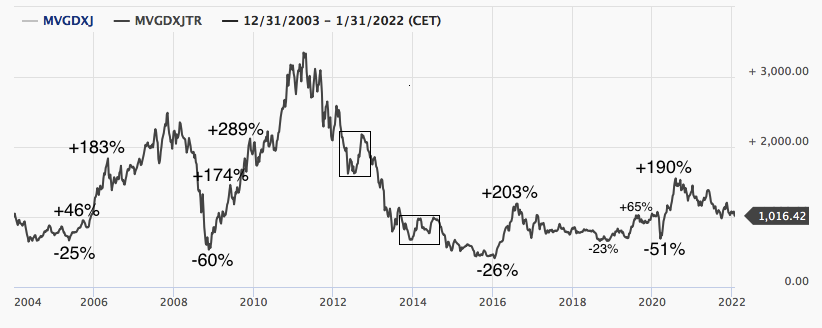

Next, here is the MVIS Junior Gold Miners Index, which is a parent index to GDXJ.

The selloffs at the tail end of larger declines have led to massive rebounds.

As I’ve detailed in past articles and videos, precious metals have a history of making bottoms when the Federal Reserve executes its first rate hike in a new cycle.

In the last three cycles of rate hikes, Gold rebounded an average of 28% after the first hike.

If the Federal Reserve has to stop or pause its rate hikes this year, then look for Gold to retest its all-time high before 2023. In this scenario, GDXJ, which could bottom as low as $30 or $32, has upside to $54.

However, it is critical to own the right stocks.

Capital will flow first to companies with large economic assets. Numerous juniors will not outperform until Gold takes out $1900.

I continue to be laser-focused on finding quality juniors with at least 5 to 7 bagger potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.