Posted on

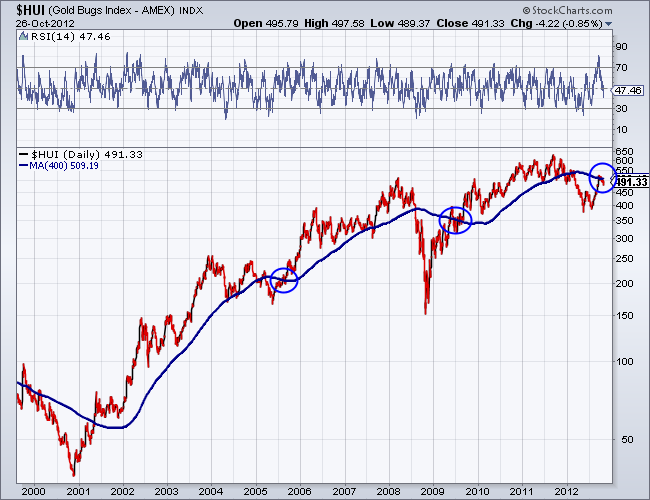

Gold, Silver & GDX Daily Report

Gold rebounded nearly 1% today after forming a base at $1700 as traders returned and US markets reopened for the first time since last Friday. Silver pushed higher by 1.6% to $32.26. “Gold has been forming a good base over the last couple of days,” Saxo Bank vice president Ole Hansen said. “Japan quantitative easing … Continue reading