Posted on

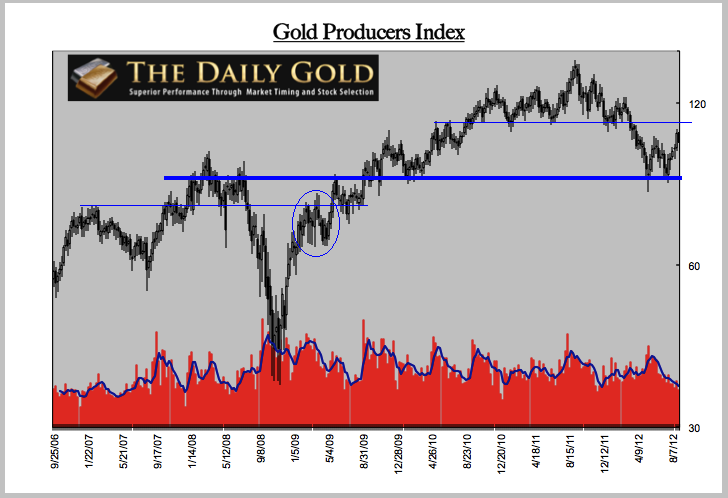

Near-Term Targets for Gold, Silver and Mining Shares

It’s amazing. Suddenly, everyone is bullish again. Two months ago you couldn’t give away mining shares or Silver. No one wanted to buy. After back to back weekly gains (for essentially the first time since January) the gold bugs are back and proud. Bullish calls are coming out of the woodwork. This is good and … Continue reading