Posted on

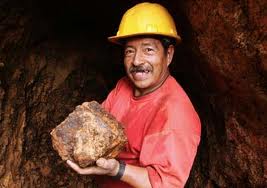

Why Gold Stocks are Set for a Big 2012

Last week we discussed the concept of relative strength. Again, relative strength is the measuring of one market against another. There are perhaps 1000 mining companies and maybe 5% of them are worthy of your research and investment. Fundamental analysis should lead you to the best companies while technical analysis (relative strength analysis in this … Continue reading