Hedge Funds Gold Short Position at 7-year High

Hedge funds are the most short Gold since 2006, according to Dan Norcini.

Alasdair Macleod of GoldMoney has also written about this. His article can be seen here.

Quoting the first part of it:

This week considerable instability developed in currency markets. The yield on US Treasuries has been rising, signalling that they may have bottomed out. And when it emerged from the FOMC minutes that some members are worrying about the commitment to buy Treasuries and mortgage securities while the British MPC were thinking of renewed QE, sterling had its biggest one-day fall for months.

Why does this matter for precious metals? It matters simply because there are some extreme positions in Comex futures. Volatility has picked up, with gold sliding $60 to a low of $1,554 mid-week and silver marked down to a low of $28.25.

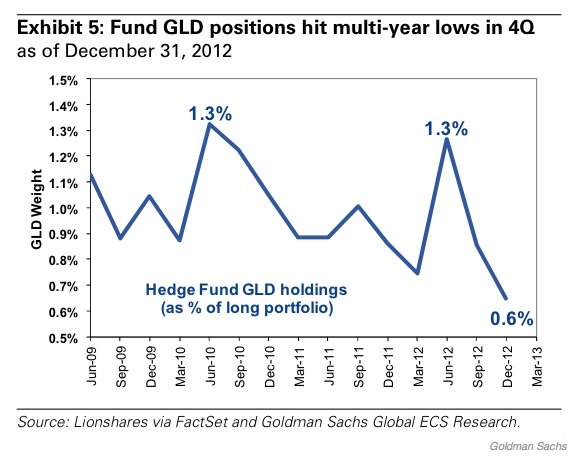

Managed money (ie hedge funds) is short of 47,357 gold contracts, a record, and can be seen as the red line in the chart below. There are 45 funds short – well over twice the average and very close to the record of 48. Furthermore, their net long position (green line) is close to all-time lows.