Posted on

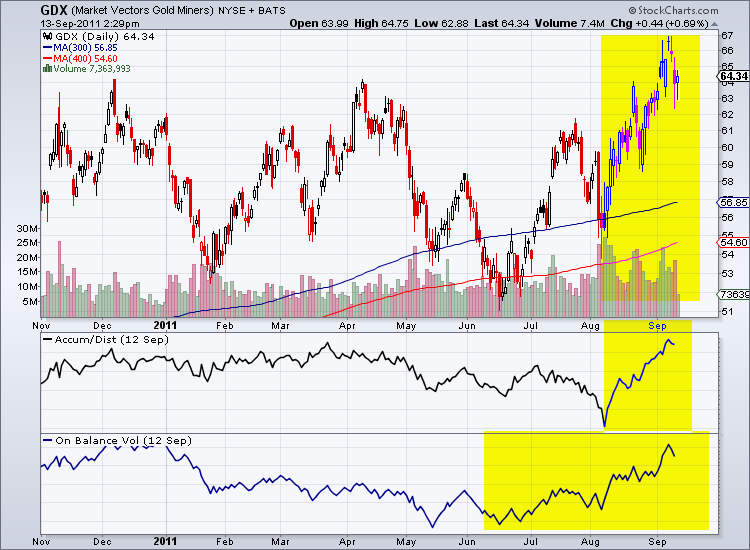

Interim Peak in Bonds Coincides with Rebound in Mining Stocks

We’ve written about the importance of intermarket analysis. Movements in various sectors and asset classes influence each other. The Treasury market is the largest in the world and affects trends in other markets. Interestingly, Bonds at times move with Gold. In these cases it is due to a safety or flight to quality play and … Continue reading