Too Many Advertisements for Gold?

The latest and most flaccid argument against Gold is the idea that the increase in advertisements for buying and selling Gold are an indication of a crowded market or public involvement. As I explained in an editorial last year, sentiment follows the trend most of the time. As a bull market matures, more and more people come onboard. Sentiment has to be bullish for a bull market to persist and this is most true in the later stages when the crowd arrives.

One of the reasons the gold bull market has far more time and room to run is that people have bubble fatigue. With numerous bubbles blowing up in the last ten years, Wall St and the public are quick to declare anything a bubble despite their inability to understand and analyze sentiment. Hence, we hear asinine concerns about too many advertisements. Tell me; are bonds in a bubble only because Pimco is advertised around the clock on CNBC?

Unlike these armchair analysts, we use a handful of sentiment indicators that are far more reliable and actionable.

Sentimentrader.com’s public opinion is simple but effective. It shows what percent of the public is bullish. Their data shows that the public was actually more bullish on Gold from 2005-2008 as public opinion spent a fair amount of time in the range of 75% to 90% bulls. In the last 24 months public opinion has yet to surpass 75% bulls.

COT data is another way to gauge sentiment. Did you know that open interest is about the same as where it was at the 2008 peak? Gold has climbed nearly 25% yet open interest hasn’t accelerated the way it did in late 2007.

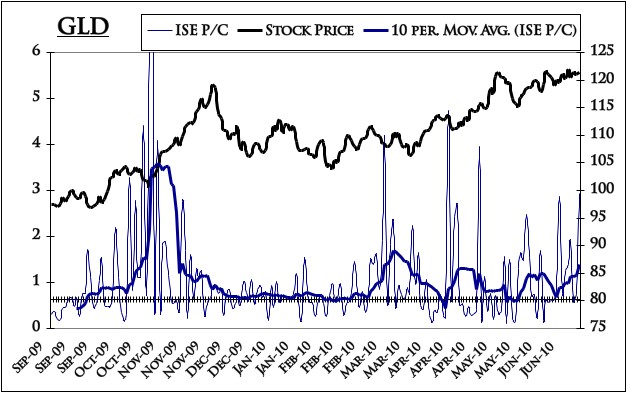

We also track put-call data from the International Securities Exchange. Below is an updated chart of GLD’s put-call. As you can see, it has been quite reliable.

Why do we focus so much on sentiment? Sentiment is more important in the precious metals markets as they are emotionally driven. Sentiment helps us predict and measure potential volatility. It helps us gauge short and medium term risk.

Even after 20 months of record gains in the precious metals and related shares, sentiment remains relatively favorable. In fact, it looks better relative to 2006 and 2008. With the collapse of 2008 still fresh in mind, investors are quick to worry and that worry is sustained and enhanced by the sustained advance in the metals and shares.

Of course the misguided and ill-informed think the spectacular recovery is an aberration. Not once have they said it’s a bull market. We have to remember that your typical trader, broker, analyst has never witnessed a bull market in Gold. They think the days of the 80s and 90s are the norm. Throw in the “bubble fatigue” as a result of the past 10 years and there will be plenty of skepticism as Gold soars to $2000/oz and higher in the next 12-18 months.

For complete sentiment and technical analysis and fundamental analysis on the gold and silver stocks, consider a free 14-day trial to our premium service.

Best of luck!

Jordan Roy-Byrne, CMT

http://www.thedailygold.com/newsletter